On the face of it, marketing for a bank or other financial institution sounds like it should be easy. After all, just about every adult needs at least one bank account, whether it’s a checking account to manage their daily finances or a savings account to serve as a cash repository until the funds are needed.

But in reality, bank marketing is a monumentally heavy lift. The entire industry faces challenges unique to banks, credit unions, and other financial institutions. Regulatory requirements, wildly diverse audiences, and lower marketing budgets, coupled with the intense competition banks face in today’s market, make for a complicated marketing situation that requires intentional planning and a high level of creativity.

Especially for the community and smaller regional banks that make up the backbones of the economies in communities across America, the challenges of standing out against a backdrop of splashy, expensive national bank ads are significant.

Fortunately, there are some answers to those challenges and even some new and emerging opportunities for banks looking to grow their business – and we’re here to share some of them.

M&R Marketing has helped community banks across Georgia grow through full-service marketing campaigns that target specific audiences and promote truly unique value propositions. We’ve even stood up an in-house bank marketing subject matter expert to help guide our services for clients in the banking, credit union, and financial industry.

What Marketing Challenges Do Banks Face? (And How to Address Them)

Bank Marketing Challenge #1: Limited Differentiators

Take any ten of your account holders at random, and ask them how your bank’s checking accounts are different from your competitors’. Ask another ten what’s unique about your CD or IRA offerings. The odds are pretty good that you’ll get twenty variations on “I don’t know.”

The fact is that most consumers see a checking account as a checking account, no matter what the sign over the door says. And, when we get down into the weeds with it – as much as we hate to say it – they’re right. You can add on special features like lower minimum balances or free checks. Still, for most customers at most banks, their account is more-or-less identical to any number of accounts available in their area.

That makes marketing your unique products so much more complicated, just because they’re not really that unique. How do you say that your checking account is the best when it’s superficially identical to offerings from thousands of other banks?

How to Meet the Challenge: Identify New Value Propositions

The way to market something that is not unique is to find something that is unique and market that instead.

No, seriously. There’s no point in spending money to advertise the things your bank does the same as a thousand other banks in your region. (A lot of them are already spending a lot of money to do just that.)

Instead, find the value propositions that do make your bank unique, the things that you do differently or do phenomenally better than your competitors. That may require some significant thought, or you might have the answers right off the top of your head. Start writing down some of your ideas.

Oh, and before you get too far down this road, there’s something we need to say. It applies to all businesses in every vertical, but particularly to institutions in the banking sector:

“Great customer service” is not a unique value proposition. Everybody says they offer excellent customer service, and many of your competitors in this market really do deliver on that promise. Building a campaign around a value as vague as “great customer service” isn’t impossible, but it’s certainly ineffective.

That’s not to say that customer service can’t be a part of your unique value propositions. But it needs to be a lot more specific – if you’re going to lean on customer service as a value prop, you need to be doing something extraordinary for your customers.

If “great customer service” means a smile and a warm hello at the teller counter, that’s not unique. If it means concierge service, a direct phone number to a dedicated personal banker, or other such high-end services, that might be worth talking about.

If you’re having trouble thinking of unique value propositions, take the time to go through this list with some trusted members of your team:

- What do we do differently from other banks?

- What do we do better than other banks?

- What do we do that, if we stopped, it would no longer feel like “our” bank?

- What do our customers tell us they like about our products and services?

- How is the language we use when we talk about our bank different from the language other banks use in their marketing?

When you have solid answers to those five questions, you’re well on your way to actually identifying your unique value props and leaving the generic ones to the other guys.

Bank Marketing Challenge #2: Tight Regulation on Marketing Messages

In most industries, so long as you don’t make demonstrably untrue claims, you’re free to market things how you want. A poorly worded ad campaign may hurt your business, but it’s unlikely to result in fines and penalties.

Not so in the banking world. Throughout our nation’s history, our state and local governments have recognized that banks can intentionally or (as is usually the case) unintentionally cause individuals serious financial harm if their marketing messages aren’t tightly regulated.

As a result, no bank marketing piece typically sees the light of day until it’s been thoroughly vetted and approved by the institution’s legal department to ensure that it complies with marketing regulations set forth by:

- US Federal Law

- State Laws

- The US Federal Reserve

- The Federal Deposit Insurance Corporation (FDIC) or National Credit Union Association (NCUA)

- The Securities and Exchange Commission (SEC)

- And other entities that regulate the banking industry

When even the way your bank displays the FDIC logo is governed by pages of regulations, crafting a marketing message that threads the needle between “enticing new customers” and “staying in accordance with regulations” can be a trick. It can also be time-consuming, as marketing concepts tend to bounce back and forth between creative and legal.

How to Meet the Challenge: Start Early and Choose the Right Partner

The regulatory landscape around financial marketing is just a given. It’s an unavoidable fact of life in this vertical, and there’s no way around it. All you can do is take steps to make sure your marketing stays in compliance without running over time or budget.

Choose the Right Partner

If you’re turning to an outside agency for your marketing, choose one with experience in marketing the banking industry. They’ll already have experience navigating the laws and regulations surrounding the industry and will produce compliant content from Day One.

If your marketing agency has an in-house subject matter expert (like the team at M&R!), that’s all the better – they’ll have more in-depth knowledge about the industry’s regulatory landscape. They can help steer the agency’s creative direction with greater effectiveness.

Get Started Early

If you know there’s going to be traffic on the way to the airport, you leave home a little earlier to avoid missing your flight. If you consider the compliance review as some heavy traffic on the way to meeting your marketing goals… you see where we’re going with this. Like driving to catch a flight, start your marketing journeys early.

When you’re launching a new marketing piece, add some additional lead time at the front of your project. If your legal team works fast, you may only need to add another week or two to the process. If you anticipate a lot of back-and-forth, add an extra month.

Have Compliance In the Room Early

This suggestion will ultimately save you time and money. Changes are always cheaper to make the earlier they happen in the creative process. All businesses, including banks, tend to want to see a marketing piece completed before it goes to legal. That’s not optimal.

If your compliance expert is in the room from the very first proof, they’ll be able to spot concerns and address them early before making changes that become time-consuming and expensive.

Bank Marketing Challenge #3: Small Marketing Budgets

Marketing a small bank is still a big job, but few bank marketing departments in the community and regional banking markets are getting the resources they need to work at their most effective. While marketing budgets in the industry generally hold reasonably steady, one major complaint from in-house financial institution marketers is an inadequate budget. Generally speaking, banks commit only about .05% of average assets to marketing each year.

In-house marketing departments tend also to be small, requiring a small team – often a one-person operation – to do all the heavy lifting for a bank’s marketing. On average, banks with average assets of less than $700 million operate with a one-person marketing staff. Until you reach banks with more than $10 billion in average assets, marketing teams tend to be smaller than ten individuals.

Today’s financial institution requires a multiplatform marketing approach that has several different components that work in unison to create an overall marketing mix. This approach requires a campaign that leverages:

- Search engine marketing

- Social media marketing

- Email marketing

- SEO services

- Traditional print advertising (newspaper, magazine, billboards)

- Broadcast advertising (radio and TV)

- Print materials (brochures, flyers, signage)

- Other marketing channels, as determined by audience and messaging

That’s a lot for one person with a small budget to manage.

How to Address the Challenge: Target Your Marketing and Find a Trusted Partner

Answering the issue of small budgets and a small staff is a familiar mantra: do more with less. There are a few strategies that can work to help marketers continue to move the needle without spending more money:

- Target Your Marketing: Using digital platforms to deliver targeted ads directly to audience members who are actively looking for banking services is considerably more cost-effective than using nontargeted ad channels.

- Automate: Automated email drip campaigns are an excellent choice for banks. They allow a single individual to set up a campaign, put it into motion, and let it run without requiring frequent human intervention.

- Try to Combine Effort: While you have to be careful with this, it can be effective. When writing or creating visual content, create elements that can be reused on various platforms. Again, take care that your messaging doesn’t become identical across all your channels.

Another answer to this problem is to turn your marketing over to an outside agency. With a team full of dedicated marketing professionals, a marketing firm can often extract more value out of a given budget than a small in-house team. With that, you’ll also gain the collective experience of the agency’s entire team – in M&R’s case, that means almost two centuries of marketing expertise!

Bank Marketing Challenge #4: Targeting a Diverse Audience

Again, it seems like it would be easy to market a bank because everybody needs a bank. But really, that just complicates the issue. Banks in today’s market are actively trying to reach members of five distinct generations, each of which has their own idea about what to look for in a bank:

- Baby Boomers: Older, more affluent, and considerably more traditional. This generation typically understands banking products and doesn’t need much consumer education.

- Generation X: This generation is underwater in terms of savings and struggles with financial literacy. They are more private and generally less eager to discuss their personal finances.

- Millennials: Millennials are reaching their forties and are starting to desire more flexibility in their banking options. They are highly resistant to traditional marketing messages and prefer a lighter, more approachable touch.

- Generation Z: Gen Zers are even more skeptical and doubtful of “traditional” institutions such as colleges and banks. They may have the highest levels of financial worry of any generation on the list and need significant consumer education.

- Generation Alpha: This generation is still mostly too young to open bank accounts, but when they enter the banking market soon, they may be the best-prepared generation yet. It’s expected that Alphas will be good bank customers, entering with high levels of literacy and more savings than preceding generations did at that age. Their expectation from bank marketing, however, will likely be an approach closer to that used for consumer goods today.

Not only that, but within each of those age groups are countless other demographics across the socioeconomic scale. The same marketing that encourages a 68-year-old retiree to open a CD with your bank will not resonate with a 22-year-old college graduate trying to build their first actual savings.

The result is that banks need multiple marketing approaches to appeal to these varying groups. But, again, that’s a heavy lift. Trying to appeal to every demographic is difficult, if not outright impossible.

How to Address the Challenge: Milestone Marketing

Fortunately, the banking industry is changing the way it thinks about audiences. When it comes to creating messaging, demographics aren’t as important as they once were. Instead, banks are learning to focus on a different way of categorizing audience members: milestone marketing.

That means focusing your messaging approaches on the milestones that make up people’s lives instead of on their demographics. Folks buying their first home—regardless of their age or affluence—tend to have many of the same pain points. The same goes for new college graduates, recent retirees, and other groups that span multiple demos.

By targeting your marketing on these milestones, you can address a much broader audience with far fewer message approaches. Some example milestones include:

- First full-time job

- Marriage

- Parenthood

- Starting over after a life change

- Inheritance

- Retirement

Bank Marketing Challenge #5: Massive Competition

When the little mom-and-pop takes on the massive big-box retailer, things usually don’t end well for the mom-and-pop. Banking is one of the few industries where small, local businesses have been able to survive the introduction of massive national and multinational conglomerates into their markets. But that doesn’t mean that the big guys make it easy for smaller community and regional banks and credit unions.

The largest banks in the nation have branches (or at least ATMs) in nearly every town, village, and hamlet across America. Online banking has made the services at Bank of America and Wells Fargo just as accessible as those at the community bank across the street. And those big, national operators have marketing budgets in the hundreds of millions, allowing them to run national TV campaigns, make massive bids on digital ad visibility, and do a thousand other things to gain business.

How to Address the Challenge: Play to Your Strengths

You can’t compete with the major national banks in terms of the number and spread of branches, may not be able to offer many of the same services, and may not be able to compete in terms of loan or yield rates. So what do you do?

As we mentioned above when discussing unique value propositions, the solution to this problem is not to try to compete on their terms but to market your uniqueness. Find what you can do better than the nationals.

Do you have local loan officers? They have a better insight into the lives of the people in your community than a major national’s loan officers would have. Do you offer concierge-level service to customers with multiple accounts? The nationals typically only offer that level of service to customers with massive balances.

Find what makes you different. Talk to your existing customers—why are they still banking with you instead of going to a larger bank? You’ll begin to see what your marketing should focus on to stand out against the onslaught of marketing from the national banks.

What Are Some Marketing Opportunities for Banks?

Bank marketing isn’t all challenges. There are some incredible opportunities out there right now, and community and regional banks across the country are capitalizing.

Improved Consumer Education and Recasting the Hero

This trend is a broader approach to marketing that fits perfectly into the banking world. Today’s consumer doesn’t want to be sold something. They want to learn about it and then make an educated purchasing decision. It comes down to the psychological urge that we all have to be the heroes of our own stories.

That’s why it may be time to recast the hero in your marketing. Instead of positioning your business as a mighty hero, coming down to help all the people out there save money or invest more wisely, your marketing should position the customer as the hero. You’re there to support them on their individual journey through life.

Another way to look at it is that your business is empowering your customers to make the right decisions for their lives. How do you do that? With consumer education.

Banking products and services are confusing to most people. What’s the difference between an APR and an APY? Why is it called a “money market” account? Why are there early withdrawal penalties on certificates of deposit? What does the Federal Reserve have to do with the interest rate on my mortgage?

By providing consumer education on various platforms, you can gain two distinct market advantages:

- With the right content strategy, you can become a trusted source of information on banking in general or on specific aspects of banking. That will increase your overall web traffic, which will increase your site’s SEO performance, which will increase your overall web traffic, which will increase your site’s SEO performance, and so on.

- As you’re the one providing education, you can play up the importance of the things you do well, which will put you in a better position when the consumer who uses your content makes a banking decision. For instance, if your bank is particularly strong at selling traditional fixed-rate mortgages, you should lean more heavily into the advantages of fixed-rates in your educational content.

Your consumer education can take different forms, depending on the audience:

- For pieces targeting folks experiencing their early-life milestones (graduation, college, first job, etc.), short, informal videos on social media are a great way to engage and inform.

- For pieces targeting people having their mid-life milestones (second home or first vacation home, elevation into higher income brackets, etc.), more traditional video content and easily digestible digital and print pieces may be more effective.

- For pieces aimed at later-in-life milestones like retirement, more detailed education that assumes a more substantial financial knowledge base on the reader’s part is probably the best bet.

Marketing to Underserved Populations

While bank and credit union account ownership is increasing in every demographic, certain populations in the United States are still underserved by financial institutions. The black and Latinx communities, in particular, still have the nation’s lowest rate of bank product usage, especially among lower-income families in these demographics.

Banks that do an excellent job authentically marketing to these communities can put themselves into an excellent growth posture. In that last sentence, one word is easily the most important: authentically. If your marketing is in any way inauthentic, if it is condescending, if it marginalizes consumers’ life experiences, or if it reads in any way as culturally appropriative, it will do more harm than good.

But when you offer products and services that can genuinely help people build a better financial future and services that help lower the barrier to entry for these populations, you can effectively position your institution as an ally and a supporter without coming across as exploitative.

Embrace Family Banking

Our culture is becoming increasingly centered around the multigenerational family group. Grandparents, parents, kids, and sometimes even the kids’ kids are discovering the financial and other advantages of multigenerational living and embracing this once-common lifestyle.

Family banking – services and products centered around providing solutions that make it easy or even advantageous to let one bank handle an entire family’s financial needs at once – is becoming an increasingly valuable line of business. This line is especially effective in smaller community banks that can pair family banking products with highly individualized customer service.

What does family banking look like?

- Providing easy access to joint and household accounts that include more signatories than the traditional married-couple account.

- Providing savings options that allow families to pool some of their savings and retain some individual savings.

- Offering simplified and affordable services for younger customers, such as no-minimum savings accounts, and providing tools to help parents better manage their children’s finances.

- Provide consumer education resources that encourage people to think about a family’s finances as a whole instead of as multiple separate entities.

- And dozens of other high-impact practices that encourage families to take a holistic approach to their overall financial management.

Family banking services are also an incredibly effective way to build your next generation of account holders. By providing your existing customers’ children with their first positive banking experience, you can cement a long-term, trusted relationship with them before they reach adulthood and begin making the transition into a more independent financial footing.

Direct Mail: Still a Winner, Even Among Younger Customers

It may be hard to believe, but everyone – especially the younger members of your audience – still loves to get mail. Overall, US consumers rank direct mail as their second-favorite type of marketing message to receive, right behind video. The “digital native” generations (Millennials, Gen Z, Gen Alpha), in particular, like to find a piece of mail in their mailbox.

With the correct messaging and accurate targeting, direct mail campaigns can be powerful drivers for new and expanded business:

- Target existing customers with incentives for opening additional accounts, taking out loans, or buying other financial services.

- Target local businesses with information about business banking or commercial loan opportunities.

- Target homeowners with information about refinancing with a more favorable mortgage.

- Target recent college graduates with unique offers on opening checking and savings accounts.

- And literally thousands of other possibilities exist.

Offer a Seamless Multichannel Experience

If you’re reading this, the odds are good that you’re an American consumer, which means you’ve almost certainly had both of these experiences:

- You sent a detailed explanation of an issue to the company via email. When a customer service rep calls back, you have to repeat everything you said in the message.

- You’ve spent hours online researching a product or service and know everything you possibly can about your options. When you call to make the purchase, you find out that the information on the web is not consistent with the reality of the situation.

Those are both examples of a poor multichannel experience. In the first, poor internal communication on the company’s part means a bad experience on yours. In the second, poor internal consistency has led you into an unexpected moment of confusion, souring you on the entire experience.

Banks that take the time to invest in creating a seamless multichannel experience gain a very potent value proposition to sell their products and services: a better customer experience.

Whether it’s installing a customer service platform that ensures all members of the support team can access all previous interactions with accountholders or implementing internal checks to ensure that changes to the business are reflected everywhere in the institution’s marketing, taking the time to perfect the multichannel experience can pay significant dividends.

Give Reassurance in Times of Volatility

We’re writing this in the early spring of 2025 amid one of the most volatile and uncertain markets in recent history. Questions about the future of the US economy, the value of the dollar, and what to expect in the coming months and years are at the top of everyone’s mind. And, as always, when uncertainty is high, fear is high.

Banks and other financial institutions that can do a good job of offering peace of mind will be well-positioned for some time to come. Fear can lead to impulsivity, and an effective bank marketing strategy will:

- Acknowledge your audience’s concerns

- Provide education to help them better understand the stories they’re hearing in the news, from acquaintances, and on social media.

- Promote products like CDs and IRAs that offer FDIC or NCUA protection along with a reasonable return on investment.

- In general, assure your customers and potential customers that you have their best interests at heart in your decision-making processes.

In times of uncertainty, people want to know they have a source of information that they can trust. By providing clear, simple, and effective education that stays away from partisan issues that can lead to pointless shouting matches, you can position your institution to be that trusted source.

You Can Do It Alone – But You Shouldn’t

Benefits of Taking Your Marketing Business to an Outside Agency

After 4,000 words, you can see that marketing a bank, credit union, or other financial institution in today’s complex market can be a heavy lift for an in-house marketing team. Particularly in the community and regional bank markets, just identifying and rallying around a unified set of value propositions can become a heavy lift.

A small in-house team can provide effective marketing services, but providing a complete, multichannel marketing strategy and executing every single step of the process at the right time and with the right message and target is a lot. With social media and website blogs requiring regular and frequent updates, leads coming in via phone, email, online, and even via text, and competition becoming stiffer every single day, an in-house staff can get overwhelmed quickly.

There are several reasons why banks and credit unions turn their marketing over to a partner such as M&R Marketing:

We’re Marketing Experts

While an in-house team will undoubtedly bring marketing savvy to the table, a small team cannot compete with a dedicated marketing firm in terms of both breadth and depth of experience.

Between our various departments, the team at M&R has almost 200 years of collective experience in marketing and communications. As a company, we’ve worked together for more than 17 years to create effective marketing tools and strategies for our clients.

In that time, we may not have “seen it all,” but we’ve seen a vast number of marketing challenges and helped solve them. We know what it takes to identify, engage, and shepherd an audience through a complex and highly personal buyer’s journey. We also know how to help businesses find the unique value propositions that make them stand out in a competitive market.

We’re Bank Marketing Experts

When it’s time to choose an agency to help boost your bank or credit union’s marketing efforts, you want to know that the team you’re trusting knows the industry and can help you navigate its unique challenges without needing to learn on the fly.

At M&R, we’ve leaned into bank marketing in a big way. We’ve developed an in-house subject matter expert who receives regular training and continuing education on trends and best practices in bank marketing. We’ve leveraged our talents to help several community and regional banks grow their business and have the benefit of every lesson we’ve learned on those journeys.

We’re Full-Service

Single-channel marketing usually doesn’t work. An effective marketing campaign requires:

- A well-thought-out and goal-aligned marketing strategy that integrates messaging and targeting for the entire marketing year.

- Effective messaging strategies for each channel you intend to use and which audiences each message will be directed towards.

- Integrated marketing practices that leverage digital marketing tools like search engine marketing, traditional marketing like TV and direct mail, and other channels that various audience members use regularly.

When all of your marketing efforts are working together, you’ll find dramatically better returns on your marketing dollars. And when all the strategy and creativity are coming from one trusted source, you won’t have to worry about taking time to make sure that every marketing piece aligns with the plan. M&R is a full-service agency offering a complete selection of marketing solutions:

- Marketing strategy development

- Brand design and messaging development

- Website design, development, and hosting

- Search engine optimization (SEO) services

- Digital marketing services

- Search engine marketing

- Social media marketing and management

- Business listing management

- Email marketing

- Video marketing

- Traditional marketing services

- Direct mail marketing

- Broadcast advertising

- Billboards

- Print advertising

- Other marketing services

- Graphic Design

- Photography

- Videography

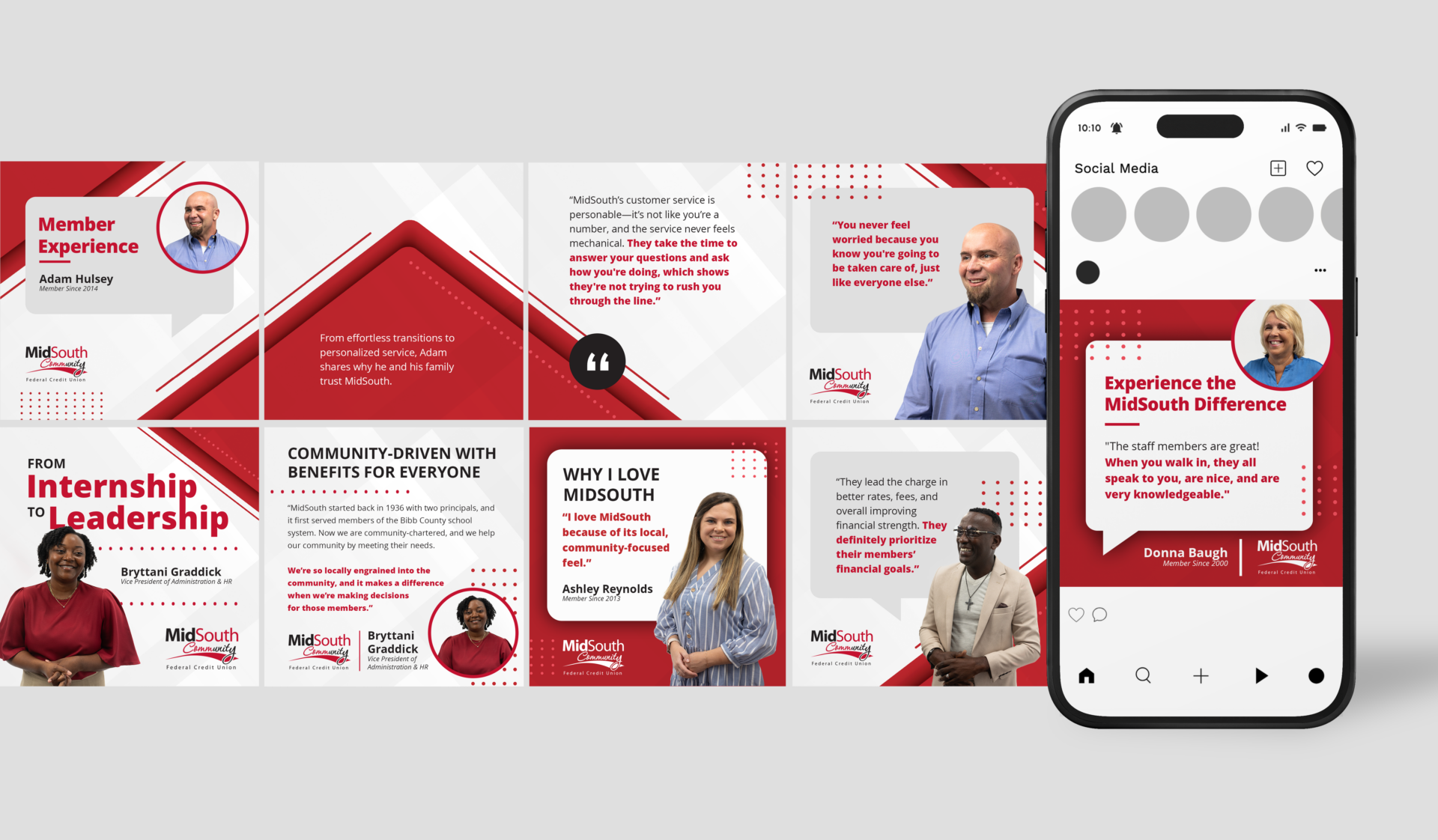

Case Study: MidSouth Community Federal Credit Union

MidSouth Community Federal Credit Union is a good example of a modern community credit union. It started as a place for employees of a certain company or in a certain field to find easy and affordable banking services while also having a stake in the credit union’s success. In MidSouth’s case, the original shareholders were teachers in Bibb County, Georgia.

Over time, the union’s rules have relaxed and the institution now serves anyone who lives, works, studies, or worships within MidSouth’s 13-county service area. Unfortunately, the credit union was not seeing the growth it wanted because people in the region still seemed to harbor three misconceptions about MidSouth and credit unions in general:

- It’s difficult to join a credit union, and membership is open only to a limited subset of the community.

- Credit unions don’t offer the same variety or quality of banking products as a traditional bank.

- Their small geographic footprint means credit unions are inconvenient.

Of course, none of those statements are true in MidSouth’s case, and they approached M&R with a need for a regional marketing campaign to dispel those myths and show Middle Georgians the advantages of banking with a credit union and with MidSouth in particular.

Following detailed discussions with MidSouth’s leadership and marketing team, we landed on the guiding message of the campaign: “Why I Love MidSouth.” Once it was established, we got to work on the various phases of the campaign.

Campaign Setup Phase

In the setup phase, we established the campaign’s overarching voice, brand message, and look.

Our solutions included:

- Testimonial interviews with members and employees

- Tagline creation

- Testimonial photography and videography

- Commercial videography

- Email marketing

- Social graphics creation

- Landing page creation

- Billboard design

Following the setup and campaign launch, we now manage a number of their marketing channels, promoting MidSouth’s name, capabilities, and products to those eligible for membership throughout Middle Georgia.

Our solutions include:

- Custom social media packages

- Social ads

- YouTube ads

- Hulu ads

- Reporting services

From the Client

“We came to M&R Marketing with a campaign idea, and they helped us strategize the concept that best fit our brand. Their insights and creativity took our campaign to the next level, perfectly aligning with our audience and goals. They understood our vision, refined it, and brought it to life in ways we couldn’t have imagined on our own. We are beyond pleased with the outcome.”

– Melissa Topping

Bank Marketing: A Labor of Love

In our work in the banking industry, we’ve found one thread connecting nearly every person we’ve spoken with: They are all 100% invested in seeing their customers enjoy a better financial future. Effectively conveying that investment requires recognizing the challenges, identifying opportunities, and building a cohesive multichannel strategy.

We understand the investment banks have in their customers because it mirrors the investment we make at M&R. In a market that presents numerous challenges to businesses looking to power future growth in a data-driven and intentional way, we are 100% invested in providing the solutions to help them do that.

Ready to See Your Bank or Credit Union Help More People Secure Their Futures? Call 478-621-4491 to Get Started With M&R Marketing.

More Definitive Guides From M&R Marketing: